Poor reconciliation practices have several negative consequences for banking and cash operations teams. They can lead to high costs and risks associated with poor operational performance as well as decreasing morale. The use of manual spreadsheets to track ATM and cash operations and fragmented data sources spread across multiple locations. The prolonged time taken for investigation continues to slow both ATM operations at banks and cash management service providers.

Sonas understands that inefficient reconciliation processes can be utterly demotivating and just waste your time. SONAS provides a solution to these problems by providing automated reconciliation & capturing source data in real time, as well as after transaction & cash cycle reconciliation. The results lead to superior transparency and reliable controls compared with conventional methods of automated reconciliation. Therefore, Sonas ATM reconciliation software not only automates the process and captures data in real-time but also reconciles any amount of transactional data from any source.

If your organisation continues to use outdated methods for ATM data reconciliation, you should cease use immediately. Let this be the last time that you have to deal with large and outdated spreadsheets that are nearly impossible to reconcile.

Automate reconciliation and reclaim your team’s time.

Quick Summary

- Manual ATM reconciliation is time-consuming, error-prone, and expensive to scale.

- Traditional reconciliation tools fail to capture and validate the complete ATM cash cycle.

- SONAS uniquely reconciles both digital transactions and physical cash movements in one system.

- OCR-enabled real-time data capture creates instant, verifiable audit trails

- Automated reconciliation significantly improves accuracy, efficiency, and regulatory compliance.

- SONAS is purpose-built specifically for ATM networks and self-service terminal environments.

What is reconciliation software?

A reconciliation software helps automate the matching-off process and replaces it with a centralized online system. Preparers using the software can retrieve real-time balances from a general ledger, carry information, and open items from prior periods. Additionally, they can compare data from the bank statement with any supporting documentation. These account reconciliations can then be signed electronically by the preparer before being sent to a reviewer for approval. Once approved, the data can be stored in the software’s database as an audit trail.

According to a report, finance teams spend 30-40% of their time on manual reconciliation tasks, significantly reducing productivity and increasing error risk. However, most reconciliation tools concentrate on the transactional reconciliation of the ATM and are missing a fundamental element when it comes to ATM reconciliation. It is essential to reconcile the ATM transactions and resolve the ATM cash cycle management. Without tracking the cash journey of an ATM with the source documentation, the audit trail is not robust. You should match the ATM receipt against the physical cash counted for full reconciliation certainty.

Sonas understands the unique issues that occur from ATM reconciliation. Sonas solves these challenges by introducing real-time data capture through OCR technology in banking (optimal character recognition), which captures an image of the source documentation in real-time. Importantly, creating an instant audit trail while tracking all related information such as the guard, employee number, time & date, and sequence number, and linking this ATM receipt to the physical cash receipt and bank data.

Users can upload supporting documents, leave comments, view company policies and procedures, and electronically view and sign off on all reconciliations and exceptions. Additionally, make data-driven business decisions with real-time analytics and reports.

Features of SONAS ATM Reconciliation Software

Real-time Data Capture

Capture source documentation from the cash cycle right at the point of entry. Providing complete transparency. Documents, such as ATM receipts, are utilised in the Reconciliation, Exceptions, and Claims Modules for review and investigation. This data is extracted into a real-time reporting and analytics module.

Cash Reconciliation

Cash reconciliation software ensures an automated validation of the cash journey. Therefore, providing complete transparency, detailed reporting, and analytics. Your entire cash cycle is recorded, allowing exceptions to be easily identified, investigated, and resolved.

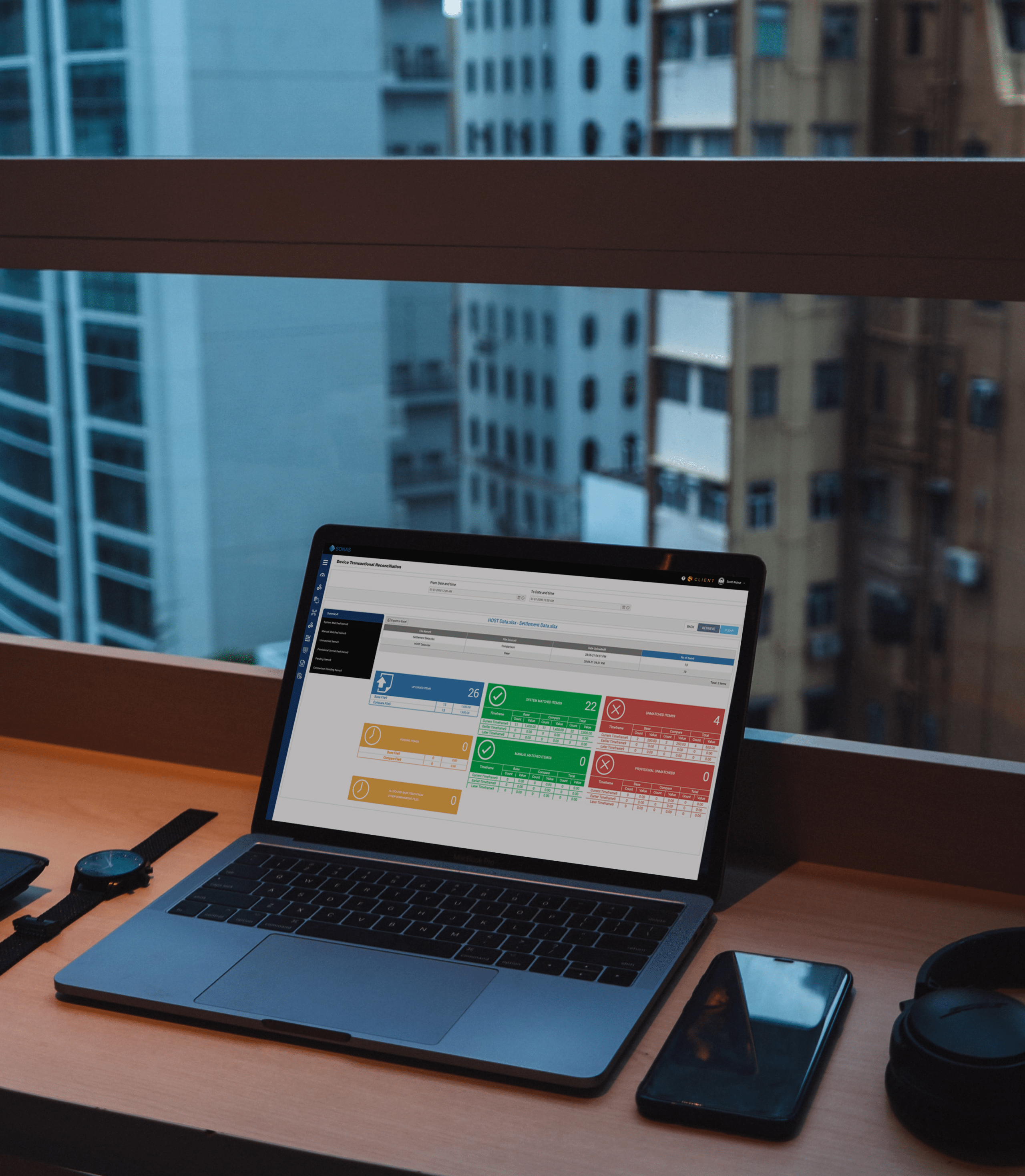

Transactional Reconciliation

Match bank transactions and internal account transactions from multiple sources to each other. Establish matching rules specific to one account or company-wide. Essentially, you can match transactions to solve differences within predetermined tolerances.

Overall Reconciliation

Gain a transparent and holistic overview of your individual terminals. With a reconciled and valuable overview of your combined digital and cash balances in real-time. Experience a new level of transparency, allowing you to make timely, informed, strategic, and operational business decisions.

Exceptions Management

Identify exceptions, track follow-up attempts, and roll forward issues into subsequent periods. Additionally, resolve via a manual matching clean-up method.

Claims handling

Investigate and resolve claims, handle the settlement process, record payments, and access a complete audit trail on one platform. This module also offers a customer portal to improve communication and resolution efforts with increased transparency.

Reporting

Visual analytics and reporting of reconciliation and device overview that list unmatched records. View suggestions for getting your account into balance. Store reports for future historical reporting and compare the differences in financial statements from previous periods.

Streamline claim investigation and resolution with SONAS and see the whole picture clearly.

Benefits of a Reconciliation Software

Both large and small businesses will benefit from the use of reconciliation software. Automated algorithms, full bank and ERP integration, and in-depth reporting. These are a few of the immediate benefits offered to a company looking to implement reconciliation software. Larger businesses will benefit even more.

Fully Automate Your Reconciliation

An account reconciliation software provides a level of automation that relies less on manual input from your employees. Ultimately, leaving you more time to analyse reports and improve other areas of your business. Automation will lead to stronger compliance, decreased costs, and speeding up the financial close process.

The controls embedded within reconciliation software will advance automation by decreasing the risk of errors. This is accomplished by ensuring all connected balance sheet accounts are reconciled (including new or recently added accounts), sending alerts to the appropriate users for approval or rework, template creation, and storing documents in the right place.

Standardize Your Reconciliation Process

An account reconciliation software will help optimize how your reconciliations are presented. This will help improve the quality and accuracy of your financial data and internal control. Many companies that perform manual reconciliations will deal with non-standardized methods. This means that their documentation is being recorded in a variety of formats and data is spread thin between different locations. Therefore, leading to data gaps. This downside is in addition to the amount of manual labor that is required to perform the reconciliations. Essentially, meaning their full-time employees are tied up from handling more important tasks.

Sonas Reconciliation software will enforce standardized rules for every reconciliation type. When it comes to auditing, the ATM software will give a standardized presentation with your reconciliations. Also, it will provide a centralised document repository.

Reduce Errors and Enhance Internal Controls

Minimise fraudulent activity by recording the entire transaction reconciliation process. Giving you total control and transparency over your cash journey. Track digital and cash transactions, monitor investigations, and manage claims in real-time.

The biggest benefit of the internal controls provided via account reconciliation software is the reduction of risk that is prevalent with manual paper-based methods. Electronic processes will help segregate duties between your staff. Also, it will automatically sync with any accounting software or ERP systems and detect missing or duplicated transactions.

Decrease Costs

Reduce physical infrastructure costs through global access to the cloud, supporting remote working and more. A consolidated platform gives you the advantage of automation, synergy between departments, a higher rate of productivity, and reduced personnel costs.

Increase Efficiency

Automated reconciliation allows your staff to focus on performance and provide seamless communication between internal departments and third parties. Source documentation and data portals enable faster investigation and resolution of exceptions and claims.

Real-Time Analytics and Reporting

Manage your business performance and conduct root-cause analysis to discover problem areas with our visual graphs, trend analysis, and drill-down facility. Detailed and comprehensive reporting offers full sight and transparency of your entire reconciliation process.

Discover how SONAS can modernise your ATM reconciliation and give you full control over your cash operations.

Business Benefits of Automated Reconciliation

Automated reconciliation results in measurable benefits of enhanced operational efficiency, reduced risk, and improved financial control, particularly in high-volume ATM and self-service terminal deployments. It offers business benefits like

Reduction in Reconciliation Time Up to 90%

Automating the reconciliation process has the greatest impact on reducing time spent on manual matching, preparing spreadsheets, and completing repetitive validation processes. Automated reconciliation allows for up to 90% reduction in the amount of time banks and cash management companies spend on the process. As a result, banks and cash management companies can shorten their transaction reconciliation, as well as provide real-time information regarding cash and transaction positions.

A Reduction in Errors, Disputes, and Revenue Leakage

ATM reconciliation software allows transactions to be validated against predetermined criteria and source documents; this minimises the potential for human error. Instantly identifying discrepancies, failed transactions, and mismatched records prevents minor variances from escalating into costly disputes and claims.

Reduction of Operating and Staff (Personnel) Costs

Automating reconciliation decreases the need for large reconciliation teams to reconcile transactions and manage the manual verification of transactions. With the help of banking reconciliation tools, the number of rework cycles and investigations is reducing. Organisations can operate with less personnel, resulting in lower cost per reconciliation transaction while still maintaining accuracy and sufficient controls.

Increased Compliance and Readiness for Audits

Automated systems generate a complete, time-stamped audit trail for all transactions and cash movements. The cash reconciliation software helps improve compliance with regulations and speeds up the audit process. It eliminates the need to compile supporting documents or manually justify data during audits.

Enhanced Internal Controls & Risk Management

Having total transparency into the ATM cash cycle management allows banks to enforce separation of duty policies, to identify early warning signs of anomalous transactions, and to have stronger governance over ATM processing, therefore decreasing the risk of fraud and operational risk.

Enhanced Internal Controls & Risk Management

Having total transparency into the cash cycle allows organisations to enforce separation of duty policies, to identify early warning signs of anomalous transactions, and to have stronger governance over ATM processing, therefore decreasing the risk of fraud and operational risk.

Why Banks & Cash Management Firms Choose Sonas

Banks and cash management operators choose SONAS because it is purpose-built for the realities of ATM and self-service terminal operations, where volume, complexity, and risk demand more than generic reconciliation tools because:

| Capability | SONAS ATM Reconciliation Software | Generic Reconciliation Tools |

| Built for ATMs & Self-Service Terminals | Designed specifically for ATMs, CDMs, recyclers, and SST environments | Built for general ledger or bank account reconciliation |

| Cash + Transaction Reconciliation | Reconciles digital transactions and physical cash together | Focuses mainly on transactional matching |

| Cash Cycle Visibility | Tracks the full ATM cash journey from loading to dispense to collection | Limited or no visibility into physical cash movement |

| OCR-Enabled Source Documentation | Real-time OCR capture of ATM receipts and cash documents | Manual uploads or no document capture |

| Real-Time Data Capture | Captures data at the point of activity with timestamps and user IDs | Periodic, batch-based data imports |

| Exception & Claims Management | Integrated exception tracking, investigation, and claims resolution | Separate tools or manual follow-ups required |

| Audit Trail Strength | End-to-end, tamper-proof audit trails with linked documentation | Fragmented audit evidence across systems |

| Scalability for Large ATM Networks | Proven in high-volume, multi-vendor ATM environments | Performance degrades as volume increases |

| ATM Vendor Compatibility | Supports multiple ATM manufacturers and switch formats | Often requires custom workarounds |

| Operational Control | Designed to improve ATM uptime, settlement speed, and control | Focused on accounting closure, not operations |

Talk to SONAS about modernising your ATM reconciliation process and gaining complete control over your cash and transaction lifecycle.

Conclusion

The ATM Reconciliation process has become much more than just matching transaction totals. Banks and cash management businesses need to have complete visibility into every digital transaction and every piece of physical cash that flows through an ATM. In addition to operational complexities, customer expectations, and audit requirements associated with the many transactions processed on ATMs today.

SONAS fills this void with its purpose-built ATM reconciliation software that collects real-time data, connects all transactions to the associated physical cash through the use of Optical Character Recognition (OCR)-enabled documentation, and provides a complete and traceable record of every ATM-related event. By automating Reconciliation, Exception Management, and Claim Management functions within a single platform, SONAS allows organisations to manage risk, increase efficiency, maintain operational control at scale, and ensure their ability to adapt to future operational challenges.

See how SONAS delivers ATM-grade reconciliation where generic tools fall short.

FAQ

1. What is ATM reconciliation software?

ATM reconciliation software is a specialised system that automatically matches ATM transaction data with bank ledger entries and physical cash movements to ensure accuracy and transparency. Unlike manual reconciliation using spreadsheets, ATM reconciliation software consolidates data from multiple sources, such as electronic journals (EJ files), switch reports, cash replenishment records, and bank systems into a single platform. It identifies mismatches like cash shortages, overages, failed transactions, or delayed settlements in real time. Modern ATM reconciliation software also maintains complete audit trails, supports exception management, and enables faster dispute resolution. For banks and cash operators managing high transaction volumes, it is essential for operational control, cost reduction, and regulatory compliance.

2. How does ATM reconciliation reduce disputes?

ATM reconciliation reduces disputes by identifying discrepancies early and providing verifiable evidence for every transaction. Automated systems match withdrawals, deposits, reversals, and cash counts across multiple data sources, instantly flagging inconsistencies before they escalate into customer complaints or financial claims. By linking transaction records with physical cash data and source documentation, reconciliation software enables faster investigation and root-cause analysis. This prevents prolonged back-and-forth between banks, cash-in-transit providers, and customers. Clear audit trails, timestamps, and supporting documents ensure accountability and transparency, allowing disputes to be resolved accurately and quickly, often before customers are even aware of an issue.

3. Why is cash cycle reconciliation important?

ATMs rely on both electronic transactions and physical cash movements; it is critical to perform a thorough reconciliation of the cash cycle. While the reconciliation of transactions confirms what the ATM records, the cash cycle reconciliation actually confirms the movement of cash from load/unload through dispense/retrieve and the count of cash at each stage (i.e., reloads, dispense, collection, and counting). If the physical cash is not tracked through each step of its cycle, gaps may exist between ATM receipts and balances in banks or vaults. Therefore, through the cash cycle reconciliation process, the system creates an entire view of the cash journey from the ATM journals, replenishment records, and cash counting data back to the bank data for that cash. The ATM cash cycle management reconciliation process provides a link between the ATM journals, cash replenishment records, cash counting data, and bank data, which gives you an end-to-end view of the entire cash transaction, as well as a basis for accountability, a reduction of the risk of fraud, and enhancement of the internal controls of the ATM Operating Model.

4. How does OCR improve ATM reconciliation accuracy?

OCR (Optical Character Recognition) significantly improves ATM reconciliation accuracy by digitising source documents in real time. Instead of relying on manual data entry or delayed uploads, OCR captures critical information directly from ATM receipts, cash count sheets, and replenishment documents at the point of activity. This data is automatically extracted, time-stamped, and linked to corresponding transactions and cash records. OCR eliminates transcription errors, improves traceability, and creates instant audit evidence showing who performed an action, when it occurred, and on which device. By integrating physical documentation into digital reconciliation workflows, OCR ensures faster investigations, stronger audit trails, and higher confidence in reconciliation outcomes.

5. Is ATM reconciliation required for audits?

Yes, ATM reconciliation is a fundamental requirement for audits, regulatory compliance, and internal governance. Auditors expect banks and cash operators to demonstrate clear control over both transactional and physical cash flows. Without proper reconciliation, organisations cannot reliably prove the accuracy of balances, identify discrepancies, or validate customer settlements. Automated ATM reconciliation systems provide structured audit trails, documented approvals, exception histories, and timestamped evidence, all of which simplify audit preparation. They also support compliance with central bank reporting requirements and internal control frameworks. In high-volume ATM environments, automated reconciliation is not just best practice; it is essential for passing audits with confidence.